Are you looking to get a deal on a foreclosure home?

Rich Kruse, Gryphon USA, October 22, 2020

As real estate buyers look for deals, many are looking to foreclosures for their next home or investment property. And, due to job loss created by Covid 19, the expectation is that many more foreclosure properties will soon be available.

If you are interested in buying at a foreclosure auction, here are a few things you should know:

How to find foreclosure properties:

You can start with a Google Search using words like foreclosure, foreclosure auction, bank owned real estate or REO, plus a geographic location. There are also websites that list foreclosure properties for sale and auction such as GryphopnUSA.com, Auction.com or Hubzu. Some other resources are RealtyTrac or Foreclosure.com. Additionally, a local real estate agent specializing in bank owned property can help. Again, you can start with Google and go from there.

Making the purchase:

There are a few ways a buyer can purchase a foreclosure property.

First, if you find a property is in foreclosure but the judicial sale has not yet been conducted, you can negotiate directly with the owner and complete a sale with them.

Second, you can find properties that are being offered by the county sheriff and bid “on the courthouse steps”, although many states are now moving to online auctions. The opportunity for a deal exists but there is also risk. If you want to go this route, be prepared to put up a non-refundable deposit and many times you will need to close the sale without the benefit of conducting an interior inspection. In some instances, you will also need to evict the occupant if they refuse to leave once you take ownership. Additionally, these offerings do not always guarantee a transfer of title free and clear of liens. It is the buyer’s responsibility to look through the courthouse file or have a title search run to satisfy themselves that title will be clear.

Lastly, you can buy property from the bank after the foreclosure auction is completed. These properties are known as REO or Real Estate Owned. Homes are listed with real estate agents, are usually vacant and can be inspected before you finalize the purchase most of the time. Remember that even though you can do inspections, it is common for these properties to be sold “as-is” and require repairs that the seller is not likely to make. However, since you now have interior access it is easier to complete the transaction using financing options.

Is buying a foreclosure or REO property different than buying non-foreclosure property?

Absolutely. There are quirks in every process and this one is no different. Even if you are a savvy investor you can still make mistakes. If you go the route of buying at auction, make sure you read through the terms of sale and get a copy of the contract you will be expected to sign before you bid. While you can go solo, consider hiring an agent. Working with a real estate agent who specializes in foreclosures can be a huge time-saver.

Keep in mind foreclosure purchases in general aren’t always easy and there may be additional expenses involved.

The low initial price does not include possible repairs such as roof, electrical or structural problems. If possible, make sure to get a home inspection. If that is not possible, be conservative in your estimates of repair especially if you are not a seasoned investor – and realize even seasoned investors make mistakes sometimes!

Also know that ALL properties these days are in demand and other people are looking to get a deal with a foreclosure property too. It is not as easy as it used to be.

And – Here is a pro tip that has made a lot of people a lot of money over the years even though it might drive your real estate agent crazy. If you spend the time and energy looking at the asset and evaluating the opportunity. MAKE AN OFFER, regardless of how crazy you think it might be. You never know when it will be accepted.

-Rich Kruse, https://www.gryphonusa.com/

Breach Letters

Receiverships

Residential Foreclosures

Commercial Foreclosures

Fortis partners with SVN Motleys as its preferred vendor for commercial foreclosures.

The Fortis Process

Client Testimonials

“Thank you and your team for a job well done regarding our 2 properties and successful outcome of the foreclosure sale. I was very pleased with the aggressive advertising campaign and the large number of interested buyers you generated. It was a pleasant surprise to have the bank whole on this deal and our customer happy as well. Your process was truly good for the bank and good for our customer. I would recommend your service to any institution requiring foreclosure services.”

- William P. Sage, Ill, Executive V.P. & CEO, Farmers & Miners Bank

“Your concept, marketing and follow up were certainly effective in helping us sell all 8 properties. I am pleased with the results and would recommend your firm to other banks interested in reducing the amount of properties brought into their OREO portfolios.”

- Ray Santelli, First Capital Bank

“I personally recommend Fortis to any financial institution that is looking to dispose of non-performing real estate assets."

- Danny Cobb, Bank of Hampton Roads

“Thank you very much for your multi-property sale for the Bank of Virginia. I have found the process to be cost effective, efficient and results driven.”

- Bruce Brockwell, Bank of Virginia

“Since using Fortis to handle foreclosures, we have experienced positive results. Their ability to market the property to the correct buyer group has lead directly to bringing higher numbers of bidders to the auction sale.”

- J.W. Bartoo, EVB

Case Studies

Fortis Glossary

Foreclosure -

Receivership -

Trustee -

Bankruptcy Sales -

Services Offered

- Trustee Services

- Receiverships

- Commercial Foreclosures

- Residential Foreclosures

- Breach Letters

Are you looking to get a deal on a foreclosure home?

Rich Kruse, Gryphon USA, October 22, 2020

As real estate buyers look for deals, many are looking to foreclosures for their next home or investment property. And, due to job loss created by Covid 19, the expectation is that many more foreclosure properties will soon be available.

If you are interested in buying at a foreclosure auction, here are a few things you should know:

How to find foreclosure properties:

You can start with a Google Search using words like foreclosure, foreclosure auction, bank owned real estate or REO, plus a geographic location. There are also websites that list foreclosure properties for sale and auction such as GryphopnUSA.com, Auction.com or Hubzu. Some other resources are RealtyTrac or Foreclosure.com. Additionally, a local real estate agent specializing in bank owned property can help. Again, you can start with Google and go from there.

Making the purchase:

There are a few ways a buyer can purchase a foreclosure property.

First, if you find a property is in foreclosure but the judicial sale has not yet been conducted, you can negotiate directly with the owner and complete a sale with them.

Second, you can find properties that are being offered by the county sheriff and bid “on the courthouse steps”, although many states are now moving to online auctions. The opportunity for a deal exists but there is also risk. If you want to go this route, be prepared to put up a non-refundable deposit and many times you will need to close the sale without the benefit of conducting an interior inspection. In some instances, you will also need to evict the occupant if they refuse to leave once you take ownership. Additionally, these offerings do not always guarantee a transfer of title free and clear of liens. It is the buyer’s responsibility to look through the courthouse file or have a title search run to satisfy themselves that title will be clear.

Lastly, you can buy property from the bank after the foreclosure auction is completed. These properties are known as REO or Real Estate Owned. Homes are listed with real estate agents, are usually vacant and can be inspected before you finalize the purchase most of the time. Remember that even though you can do inspections, it is common for these properties to be sold “as-is” and require repairs that the seller is not likely to make. However, since you now have interior access it is easier to complete the transaction using financing options.

Is buying a foreclosure or REO property different than buying non-foreclosure property?

Absolutely. There are quirks in every process and this one is no different. Even if you are a savvy investor you can still make mistakes. If you go the route of buying at auction, make sure you read through the terms of sale and get a copy of the contract you will be expected to sign before you bid. While you can go solo, consider hiring an agent. Working with a real estate agent who specializes in foreclosures can be a huge time-saver.

Keep in mind foreclosure purchases in general aren’t always easy and there may be additional expenses involved.

The low initial price does not include possible repairs such as roof, electrical or structural problems. If possible, make sure to get a home inspection. If that is not possible, be conservative in your estimates of repair especially if you are not a seasoned investor – and realize even seasoned investors make mistakes sometimes!

Also know that ALL properties these days are in demand and other people are looking to get a deal with a foreclosure property too. It is not as easy as it used to be.

And – Here is a pro tip that has made a lot of people a lot of money over the years even though it might drive your real estate agent crazy. If you spend the time and energy looking at the asset and evaluating the opportunity. MAKE AN OFFER, regardless of how crazy you think it might be. You never know when it will be accepted.

-Rich Kruse, https://www.gryphonusa.com/

FAQs for Noteholders

FAQs for Buyers

Featured Sales

View our featured properties here and check often for updates.

Contact Us

Headquartered in Richmond, VA, Fortis focuses on a systematic and compliance-driven approach throughout the process. Accessing more than 50 years of experience in asset disposition, Fortis has an unwavering commitment to meeting the needs of our customers and delivering the highest level of performance.

Contact us today to learn more.

Fortis: A Foreclosure Services Company

A Division of Motleys Asset Disposition Group

3600 Deepwater Terminal Road, Suite 202

Richmond, VA 23234

phone: (804) 486-4544

fax: (804) 232-3301

Fortis Team

Trustee Auction Results

Better for Your Business. Better for Your Customer.

Headquartered in Richmond, VA, Fortis focuses on a systematic and compliance-driven approach throughout the foreclosure process. In addition to foreclosure services and by partnering with Fortis counsel Roy M. Terry JR., Fortis can act as a Receiver, send Breach Letters, and help provide solutions for all of your real estate needs. Accessing more than 50 years of experience in asset disposition, Fortis has an unwavering commitment to meeting the needs of our customers and delivering the highest level of performance.

What is the Fortis’ revolutionary way of handling foreclosures? It’s easy. We are a one-stop foreclosure services company that handles every aspect of the transaction.

This means we:

- Conduct a Comparable Market Analysis to help you confidently set the reservice price of the property

- Take care of all of the legal compliance

- Execute an aggressive marketing campaign to bring buyers to the auction

- Qualify the buyers in advance of the sale

- Hold the auction

- Close on the property

What do you do?

You rest assured your matters are being handled with the utmost professionalism.

We serve banks, thrifts, S&Ls and private investors. We work with note-holders to streamline the foreclosure process and maximize the value of the asset. We have conducted hundreds of foreclosure sales with the singular goal of maximizing the financial outcome for our clients.

We can handle any type of foreclosure, including:

RESIDENTIAL | COMMERCIAL | INDUSTRIAL | CONDOMINIUMS | MULTI-FAMILY | LAND | LOTS | FARMS & MORE

Let Fortis work with your foreclosure and special asset teams to review high-risk properties and develop a resolution strategy that puts your bank on the path to certainty.

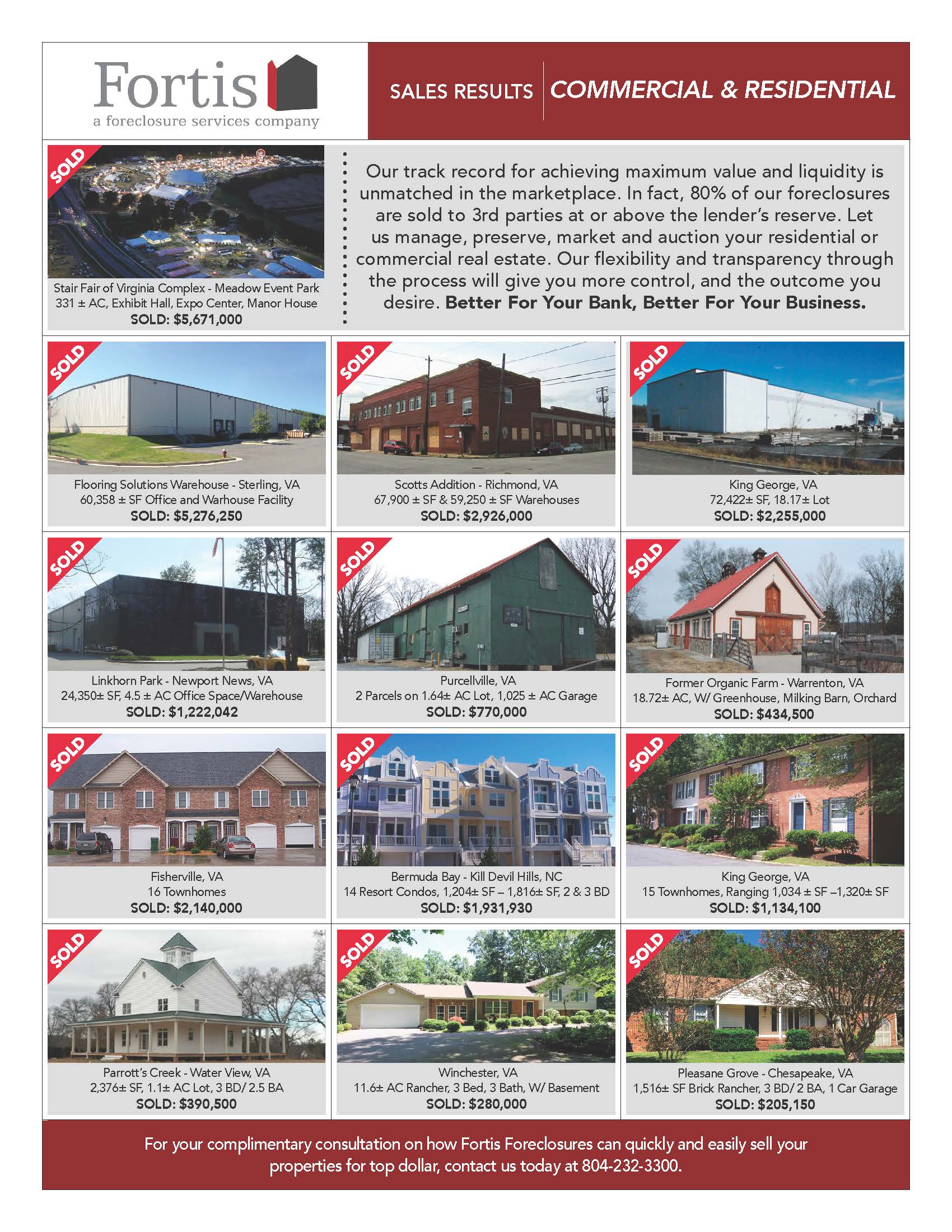

Our track record for achieving maximum value and liquidity is unmatched in the marketplace. In fact, 90% of our foreclosures are sold to 3rd parties at or above the lender’s reserve. Let us manage, preserve, market and auction your residential or commercial real estate. Our flexibility and transparency through the process will give you more control, and the outcome you desire.